Top sports brand Lululemon the secret of success

- Share

- publisher

- Eation

- Issue Time

- Sep 2,2024

Summary

The sports brand market has new players entering every year, but Nike and Adidas head brands still sit firmly in the market share of the throne. However, a Canadian brand that emerged in 2018 has made these "number one players" a little restless: lululemon

The sports brand market has new players entering every year, but Nike and Adidas head brands still sit firmly in the market share of the throne. However, a Canadian brand that emerged in 2018 has made these "number one players" a little restless: lululemon

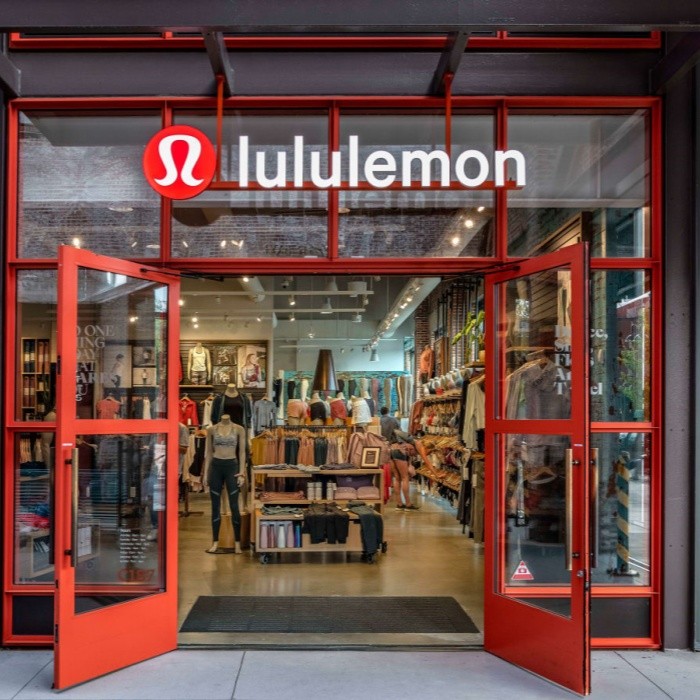

In 2022, lululemon overtook Adidas for the first time with a market value of 37.4 billion US dollars, becoming the world's second largest sports brand after Nike. As of July 30, 2023, lululemon operated a total of 672 stores, and the annual sales per square meter of stores were once $20,800, second only to Apple and Tiffany.

On March 22, lululemon released its financial results for the fiscal year 2023. For the full year of 2023, the company's net revenue increased 19% year-on-year to $9.6 billion, and gross margin increased 290 percentage points year-on-year to 58.3%; Net profit rose 81.35% from a year earlier to $1.55 billion.

Why does it generate such commercial power? What business model is behind it?

How did Lululemon rise?

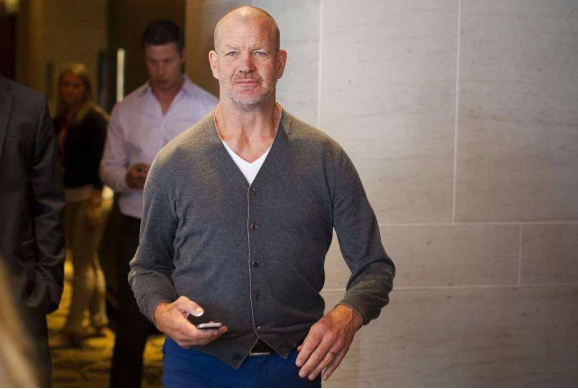

Founder of Lululemon Canadian Chip Wilson was born in April 1955. For as long as Wilson can remember, his family has struggled.

After entering the university, Wilson entered the United States oil pipeline company by chance after the end of his sophomore year. It was a boring, barren place, but in the oil boom years, working for the world's largest private oil company was very attractive, even though the working conditions were extremely cold, but the pay was several times higher than outside work.

Surrounded by fellow workers addicted to drinking and smoking every day, in such an environment, Wilson did not degenerate, in his spare time to complete the New York Times best-selling 100 books. After 18 months working on an oil pipeline, he had saved the equivalent of $600,000 today and left.

After graduating from college, Wilson was confused about what he wanted to do with his life. By chance, he noticed that there was a company called OP that specialized in providing surf clothing, which could also be worn everyday. Wilson thought this was going to be a new trend and started his first business.

In 1979, Wilson started a clothing retail business called the Westbeach Company. For the next 18 years, Wilson was rooted in the business of selling ski and surf gear.

Later, when he joined a yoga class, he noticed that many of his classmates were wearing uncomfortable clothes. These cotton-polyester blended fabrics made of sportswear can not take into account the close-fitting, sweat effect. At the same time, the rise of yoga in Europe and the United States, but there is no clothing designed for women's fitness, usually just a copy of male sportswear.

300 billion market value of the road to progress

Wilson sold the ski equipment company and, with superior business acumen, chose to use lightweight, close-fitting textile materials to create a black yoga pants for women.

In 1998, Lululemon was born. The early target audience of the brand is positioned as the new middle class women, who pursue a high quality of life, do not worry about price, and pay more attention to fabric performance and fashion.

At the beginning of the business, Wilson opened his first store in Vancouver, Canada, and provided yoga pants to instructors in the studio for free to show in front of students and receive feedback.

With the support of this group of loyal seed users, Lululemon quickly rose to prominence and became the founder of the sports leisure trend. The brand has built a series of loyal communities around its stores, extending from Canada to the United States.

In 2005, Canada's Avon Capital invested in Lululemon, giving the brand the opportunity to expand significantly. Since then, Lululemon has rapidly expanded into the U.S. market, gradually expanding to cities such as Los Angeles and San Francisco, and also set eyes on distant international markets such as Japan and Sydney, and the number of stores has quickly increased to 80.

In 2016, Lululemon officially opened physical stores in China, and has opened three stores in Shanghai Pudong International Financial Center, Shanghai Jing 'an Kerry Center and Beijing Sanlitun.

In 2020, Lululemon's market value exceeded $40 billion. It is remarkable that, in contrast, Adidas after 68 years, Nike after 46 years to reach a similar level of market value, and lululemon only took 22 years. Lululemon's rise has been a spectacular chapter in the brand's history.

In November 2021, Lululemon's share price once reached its highest point in history, with a price of $485.82 per share, and a total market value of more than $62 billion, equivalent to nearly 400 billion yuan. This achievement once again proves the global appeal and commercial value of the brand.

lululemon success secret

Differentiated positioning

lululemon is located in the athletic shoe clothing track, the market competition is fierce, and the concentration is high, and the market share is mostly concentrated in a few head brands.

To dig the increment, the sneaker clothing brand must avoid the field that the giant has been deeply cultivated for many years, but meet the potential needs of users in the vertical subdivision track. lululemon is to avoid Nike, Adi long-term deep cultivation of the male sports market, in the field of female sports to find "yoga" such a market gap.

Target audience: super girls

Founder Chip Wilson once described lululemon's target audience as "super girls," 32, unmarried, highly educated, with an annual income of $100,000 to $150,000.

The portrait of lululemon's mainstream user base in China is also very close to Chip Wilson's description. According to data from various sources, lululemon's Chinese user portrait is "a female between the age of 24 and 36, with an annual income of more than $80,000, a high degree of education, a house of her own, an hour and a half of exercise every day, and a positive attitude toward life."

Products: Leading in the fabric technology industry

Fabric technology industry leading, build a strong technical barrier to solve the drawbacks of traditional yoga pants. In the early days, the company solved the outstanding problems of traditional yoga pants with its first core fabric, Luon.

1) "camel toe" problem: Through seamless cutting and diamond lining design, "camel toe" problem is effectively avoided.

2) Transparency problem: Because most of the fabrics used in yoga pants in the early days are relatively thin and light, it is easy to appear transparent when making large movements such as stretching. The company combines 86% nylon with 14% lycra to form an improved fabric, and the transparency problem is well solved.

3) Hygiene and cleaning issues: On the one hand, the company's yoga pants absorb sweat and are not easy to stink, so as to avoid women's embarrassment due to hygiene problems during exercise; On the other hand, the company's yoga pants are inexpensive, easy to clean, and can be placed in the washing machine for washing. In addition, the company also invented many innovative designs in the field of yoga pants, which are still used today.

4) Invisible pockets: The product has invisible pockets on both sides or back, which can be used to install personal items such as mobile phones during sports.

5) Outer seam design: Yoga has more movements and requires close-fitting clothing, so the traditional inseam design will cause bad friction during exercise. The company's innovative use of outer seam design not only effectively avoids the friction generated in the movement, increasing the comfort of the product, but also plays a role in modifying the female figure through the outer sewing thread, which can visually elongate the legs and lift the buttocks.

6) Reflective bottoms: At the bottoms of the pants, the company cleverly designed reflective strips to ensure the safety of the wearer in the night and other environments.

Channel: Create a closed-loop DTC strategy for direct users

Some may ask: What is DTC? DTC (Direct to Customer) is a direct-to-consumer business model, which means that the brand directly grasps the consumption channel and provides consumers with an end-to-end purchasing experience.

Lululemon is indeed an unusual sportswear brand. Big Brother Nike, Adidas and other traditional sports brands in the development process, in addition to the store direct operation, official online store, have distribution and outsourcing business models, which can ensure that the brand to a large extent to increase sales, expand coverage, enhance market share.

However, Lululemon did not copy the existing job, but took a new path to focus on DTC. The reason why we adhere to DTC so much is that through the vertical retail system, we can analyze consumer data, improve the level of interaction with customers and the ability to respond to services, create a marketing closed loop, and comprehensively improve the consumption experience.

Wilson, the founder, said: "I want to maintain 100% control of my brand and not be diluted by any middlemen. That means staying away from wholesale as much as possible and embracing vertical retail (DTC) completely."

Wilson's business idea: to open its own stores, take revenue from manufacturers and retail outlets, and invest that money in employees and products. Employing some highly educated people, they can improve the value of products by influencing customers with ideas, so as to make women's functional sportswear more beautiful, comfortable and comprehensive, and then sell it at a high price.

Great technology is not possible in the wholesale model. As a wholesaler, I produce at a cost of $40, sell to the store for $80, and the store will sell to the customer for $160. With a vertical model, I can get the cost of the pants down to $30 and sell them in my own retail store for $90. At $90, I'm sure I could sell thousands!

The math problem works like this: The original profit of $40 per pair of pants, and the profit margin of 40/80=50%, the consumer can buy it for $160, now the profit of $60, the profit margin is 60/90=66.7%, the consumer can buy it for $90, and can sell more.

Another danger of wholesale is losing control of promotions. Too much product discounting can reduce the value of full-priced items, and deep discounting can also damage a brand's overall image.

One of the benefits of vertical retail is total control over the brand and customer experience, controlling store display, employee hiring, and creativity in every detail customers see in the store.