Lululemon's growth slowdown has peaked?

- Share

- publisher

- Eation

- Issue Time

- Oct 16,2024

Summary

Lululemon has been a dominant player in the athleisure market, known for its premium sportswear and loyal customer base. However, recent reports suggest that the brand's growth is slowing in the United States.

Lululemon has been a dominant player in the athleisure market, known for its premium sportswear and loyal customer base. However, recent reports suggest that the brand's growth is slowing in the United States.

With the rise of competitors such as Alo Yoga appealing to consumers with a more lifestyle-focused approach, the rise of cheap "imitations" has also caused the market to slow down. While Lululemon remains a strong market player, the increased competition highlights an evolving market where brand loyalty is being tested more than ever.

1.Lululemon's strong position in the US sports and leisure sector is under increasing pressure

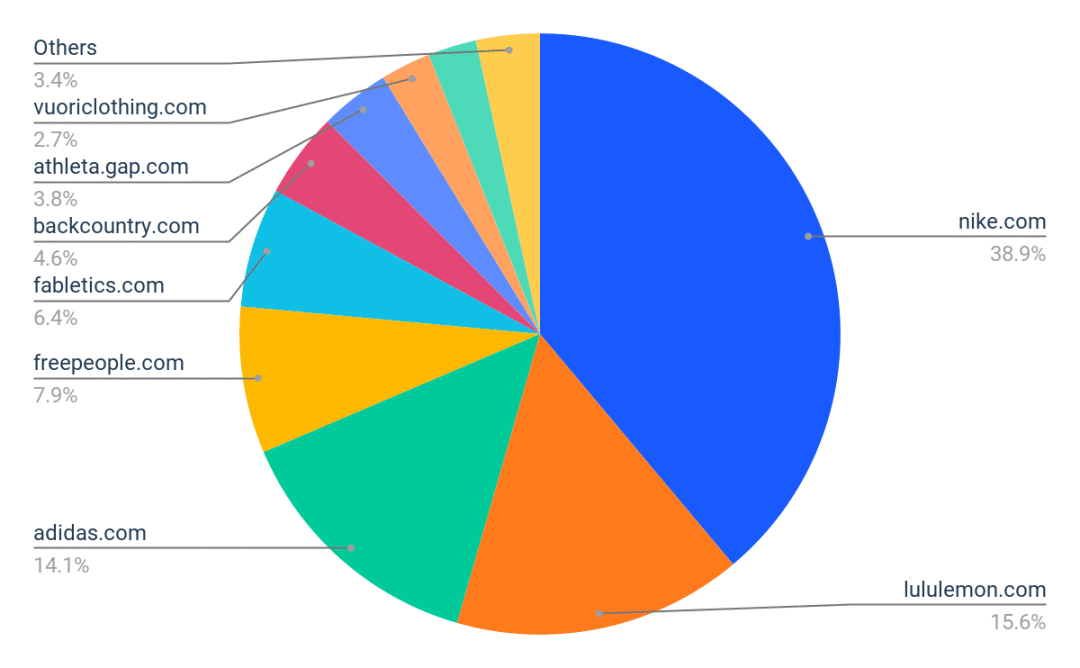

As of the end of August 2024, Lululemon's year-to-date visits in the U.S. DTC sports and leisure market accounted for 15.6% of the market share. That puts them ahead of Adidas and second only to Nike, which commands a sizable 38.9 percent share.

However, Lululemon's market share, which was dominant earlier this year, has since slipped, falling to 14.5 percent in the last three months, behind Adidas' 16 percent. The decline in market share has come not only from established competitors such as Adidas, but also from smaller but fast-growing competitors such as Alo Yoga, Vuori and British brand Gymshark.

While Lululemon still has a large following in the U.S., these shifts suggest that their brand loyalty may be wavering as consumers shift from more casual-focused brands like Vuori to more affordable brands like Gymshark.

2. Growth appears to be slowing

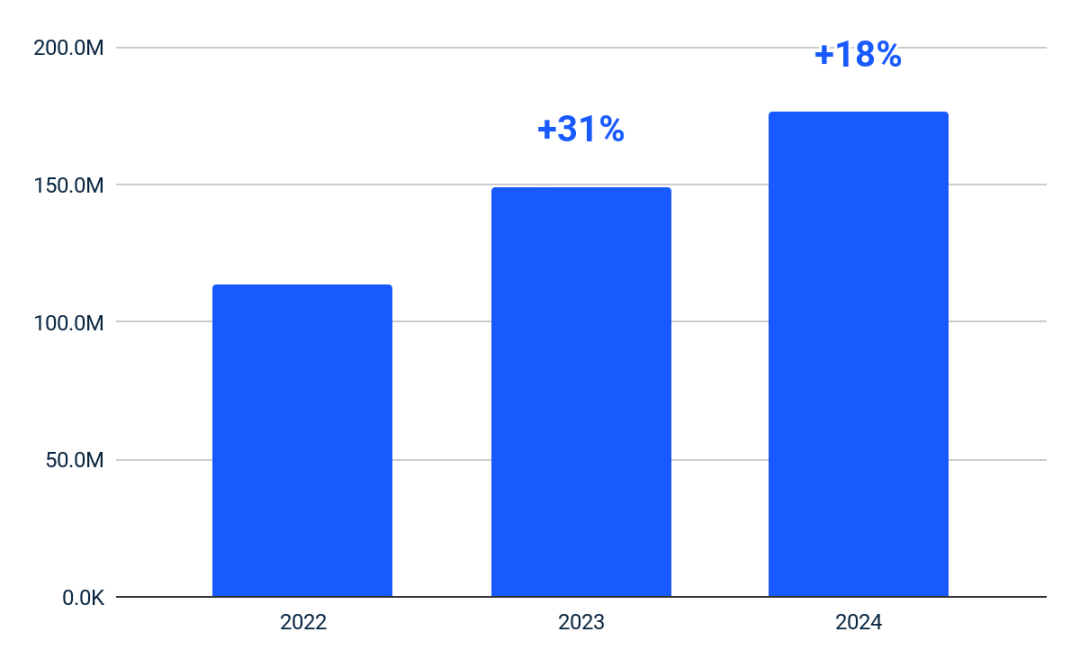

The growth rate of visits to Lululemon's website in the US has slowed from 31% in 2023 to 18% in 2024, according to the table

They may have encountered several key problems:

This slowdown suggests that Lululemon may be facing several problems:

As mentioned above, the athleisure space has become more crowded with the rise of competitors such as Vuori, Alo Yoga and Gymshark. These brands are gaining traction, offering compelling alternatives that cater to different market segments and drawing traffic away from Lululemon.

After years of rapid growth, Lululemon's core market may have reached saturation. Many consumers who fit the brand's premium positioning already own Lululemon products, and Lululemon prides itself on the quality of its products, so consumers may not need to replace products, thereby reducing repeat visits and purchases.

As the trend evolves, so do consumer interests. As a result, shoppers are increasingly looking for new brands that offer niche advantages - such as Alo Yoga's holistic lifestyle approach. The diversification seems to be luring potential customers away

Lululemon's website.

Despite Lululemon's legions of fans, some consumers may be experiencing "brand fatigue" as the Lululemon aesthetic has become ubiquitous and no longer feels unique. As newer, fresher brands rise, consumers may be more inclined to explore other options, impacting website traffic.

3. Why does this happen?

Potential inefficiency in marketing strategy

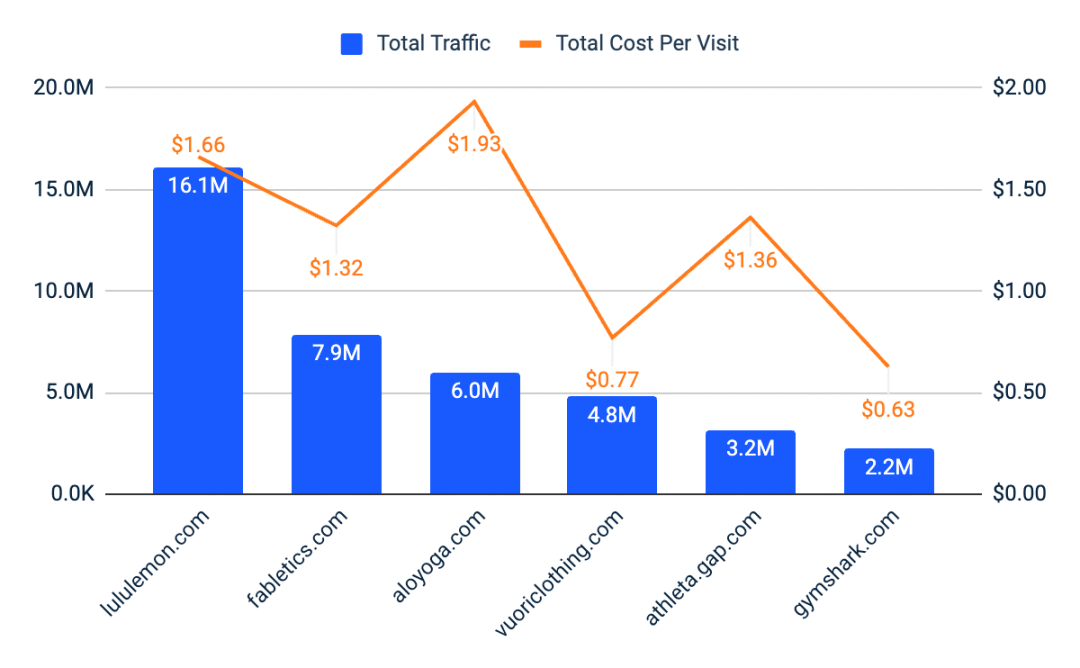

While Lululemon attracts a lot of traffic through paid search on PC and mobile platforms, there seems to be room for improvement in their marketing strategy. One area of concern is their relatively high cost per visit. Among its closest competitors, Lululemon has the highest cost per visit, second only to Alo Yoga, indicating that they are paying more to attract traffic than their competitors. Gymshark, by contrast, spent more than a dollar less per visit while still achieving strong engagement, suggesting a more efficient allocation of marketing spend.

The discrepancy highlights the potential inefficiencies of Lululemon's paid search efforts. While their brand awareness allows them to attract a lot of traffic, the high cost suggests that they may not be targeting the right audience as effectively as their competitors, or that they could improve relevance and lower bidding costs by improving their keyword strategy.

In addition, diversifying access to data by focusing more on natural search, social media, or influencer partnerships can reduce reliance on paid search, reduce overall marketing costs, and enable them to invest in other areas, improve ROI, and fight back against competitors.

Economic pressures lead to price sensitivity

Competitors challenging Lululemon's market share are not just Alo Yoga and Gymshark; The rise of cheap alternatives on platforms such as Amazon has also increased competition. Inflation and economic uncertainty could also dampen growth.

Lululemon's high price may deter budget-conscious consumers, who now prefer more affordable options.

From January to August 2024, the Yoga category on Amazon in the United States saw significant growth, with unit sales and revenue increasing by more than 25%. The main driver of this growth was the yoga skinny pants category, which saw an impressive 30% increase in both volume and revenue.

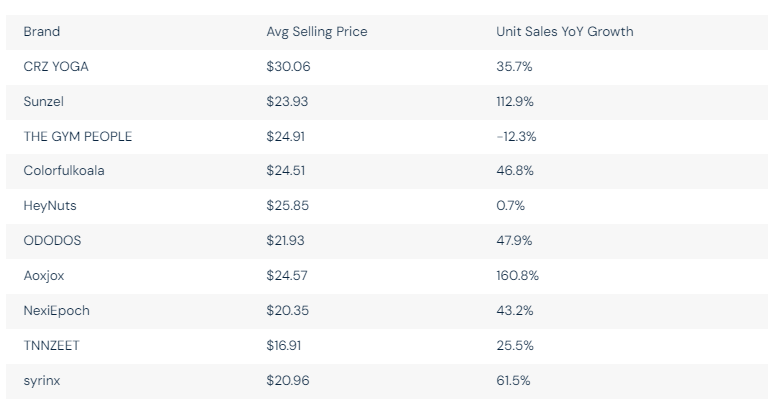

Of particular note are the price points of these leading brands. A deep dive into the top 10 brands in Amazon's yoga leggings category shows that they sell for an average of $30 or less - much cheaper than Lululemon's leggings, which sell for about $100.

That price difference is luring budget-conscious consumers away from high-end options like Lululemon, especially as the quality of affordable alternatives continues to improve. These Amazon brands are leveraging the platform's convenience, aggressive pricing and broad reach to capitalize on the growing demand for affordable activewear.

In addition, many brands benefit from Amazon's fast delivery, easy returns and user reviews, which make it easier for shoppers to trust low-priced items. This is an attractive value proposition for consumers who prioritize functionality over brand loyalty or fashion trends. Lululemon faces the challenge of defending its market position in the face of these low-cost competitors that have risen rapidly with convenience and affordability.

Given this trend, Lululemon needs to adjust its strategy to compete not only with high-end DTC brands, but also with the increasingly popular affordable alternatives on major e-commerce platforms such as Amazon, AliExpress, Temu, and others. Whether by strengthening the premium value of its products or exploring new pricing and distribution strategies, Lululemon must address this rising threat from below.

It fails to meet the needs of today's consumers

There are several factors contributing to this surge in conversion rates:

Alo makes effective use of influencer marketing, athlete sponsorship and social media partnerships to drive significant traffic to its website. These targeted campaigns often feature influencers showcasing Alo products in an intimate and desirable way, thus establishing a direct link from inspiration to purchase, driving conversion rate growth.

Alo focuses on trend-oriented, fashion-forward sportswear that is also streetwear, attracting style-conscious consumers who are more likely to buy immediately. This versatility makes the brand appealing to shoppers looking for something that fits both sporty and everyday wear.

Alo's positioning as a health and lifestyle brand, rather than just an athletic wear company, has cultivated a loyal customer base that resonates with its broader content of yoga, mindfulness and wellness. This alignment with customer values and lifestyles enhances their ability to convert visits into sales.

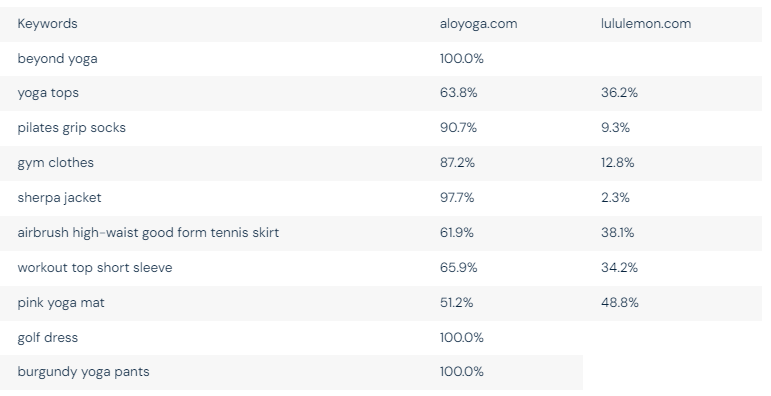

This can be seen in Alo's keyword traffic in beating Lululemon: Words covering fitness wear, yoga gear, or very specific product searches indicate that consumers know the exact items they are looking for and visit Alo to buy those products.